MUMBAI: As the Mahayuti government faces its first budget after the assembly polls, it will have to walk the tightrope between controlling its massive debt and fiscal deficit while continuing its welfare schemes, with polls to local bodies including municipal corporations and gram panchayats due this year.

Government could focus on keeping its welfare schemes going while scrutinising and trimming beneficiaries as it has done with its flagship Mukhya Mantri Majhi Ladki Bahin Yojana. It is already apparent that chances of hiking the Ladki Bahin stipend from Rs 1,500 to Rs 2,100 per month as promised in the Mahayuti poll manifesto will be unlikely in this budget.

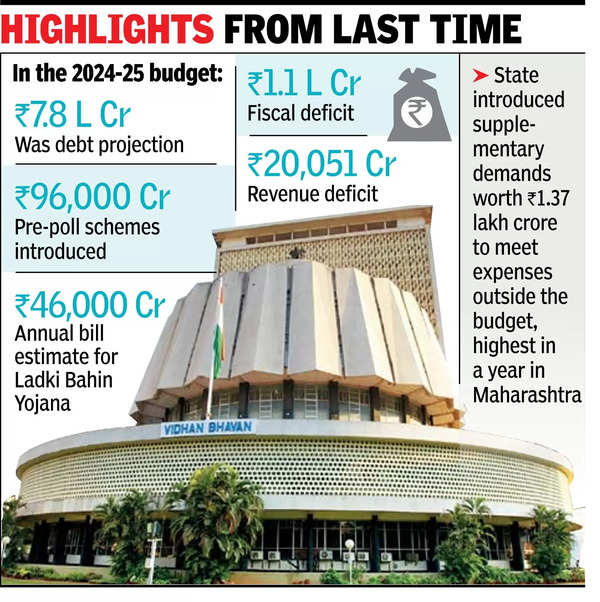

With CM Devendra Fadnavis announcing a rise in outlay under Namo Shetkari Samman Nidhi for farmers from Rs 6,000 to Rs 9,000 per year, the budget may account for this. The state’s debt projection for 2024-25 was already Rs 7.8 lakh crore. Before the polls, it had introduced welfare schemes worth a steep Rs 96,000 crore, including the Ladki Bahin Yojana which helped drive its electoral victory.

Since then, the state has introduced supplementary budgetary demands for additional expenses outside the budget worth Rs 1.37 lakh crore, the highest ever in Maharashtra.

At Rs 1.1 lakh crore by July, the state’s fiscal deficit had spiralled upwards. By Oct 2024, the finance department had warned that the fiscal deficit was estimated at Rs 2 lakh crore and will be impossible to fill.

Officials say the state will try and bring the fiscal deficit down to 3% of the GSDP, which is required by budgetary management norms. Fadnavis told TOI in the past that the state will not cut welfare or infrastructure spending but will focus on increasing revenue.

However, the global slowdown will be a challenge to revenue generation. Fadnavis had said the state would focus on raising finances, including through borrowings, monetisation schemes and annuity schemes or build-operate-transfer schemes for infrastructure projects.